Answers to Common Questions About Trusts & More

Few people understand the terminology and technicalities of trusts until they discover they need one… and by then it may be too late. Use this list of frequently asked questions (and their answers) to help you better understand the reasons for trusts and the process involved in establishing them. After going over common questions about trusts, including living and irrevocable trusts, this page covers questions regarding wills, durable powers of attorney, Virginia estate law, information about our elder law firm, and more.

Are you in or near Williamsburg and don’t yet have a trust or other plans for your estate in place? Work with Zaremba Center for Estate Planning & Elder Law for comprehensive planning and documentation of your estate.

Trusts

General Estate Planning

Elder Law

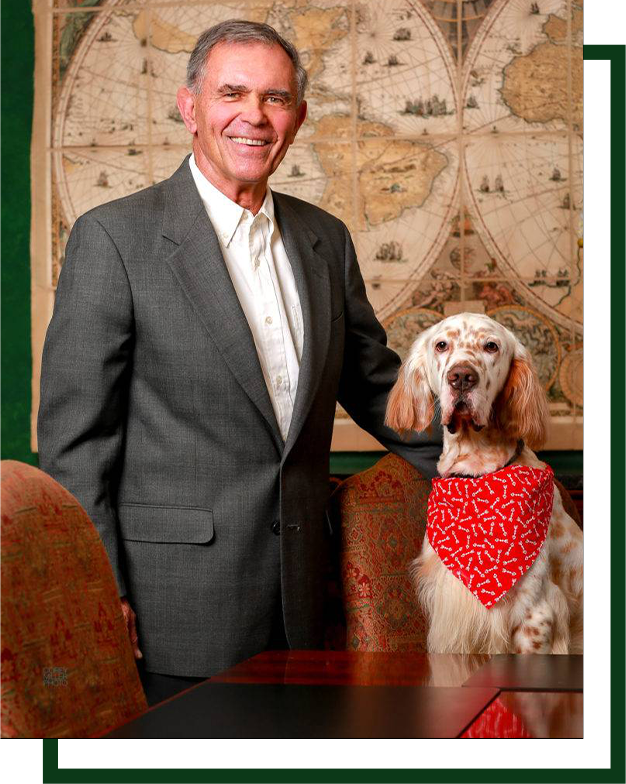

Zaremba Center Company Information

Why Choose Zaremba Center?

Zaremba Center Estate Planning & Elder law in Williamsburg offers comprehensive estate planning services. From drafting your will to setting up a living trust, we work hard to ensure that your assets are managed according to your wishes.

Communication is the Key

When it comes to estate planning and elder law, it’s all about communicating your intentions clearly. Zaremba Center is committed to creating an estate plan that does just that for you — giving you a voice in what happens to your estate, not just the court system or governmental bureaucracies. Work with us today to stay in control of your health and wealth, regardless of your current and future circumstances.